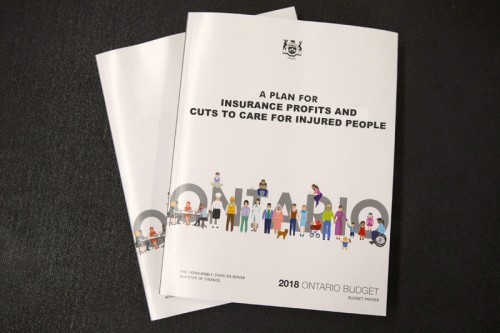

The Ontario Liberals’ 2018 budget has a section on auto insurance reform and frustratingly (but unsurprisingly), it is focused entirely on reducing rates rather than on enhancing protections.

You can read about the plan here: 2018 Liberal Budget Auto Insurance Plan.

There are four substantive steps described in the budget’s plan to reform auto insurance, none of which is likely to have much of an effect on your insurance rates, but all of which will lead to reduced benefits and protections for people injured in car accidents. Here’s a look at the reality behind the 4 key promises:

1. FRAUD

BUDGET PROMISE: “CRACKING DOWN ON FRAUD BY LAUNCHING THE PROVINCE’S FIRST SERIOUS FRAUD OFFICE, WITH AN INITIAL FOCUS ON AUTO INSURANCE FRAUD”

If fraud is happening, of course it should be stopped. But there are two obvious questions here:

First, who are all these fabled fraudsters who have nothing better to do than steal $2,200 worth of unneeded physiotherapy and then undergo a bunch of examinations by insurance doctors? If fraud really is happening at a significant level, it’s important to remember that it’s not being committed by phony accident victims, which is what always seems to be implied when insurers complain about fraud.

And second, where is the concrete evidence that this fraud, whatever its form, is actually occurring and is driving up rates? If it is actually known for a fact that people are defrauding the system, that is a serious crime and surely those people are being charged and convicted.

So… where are they all? Why is it so hard for the insurance lobby to point these thousands of convicted fraudsters to justify their claims that fraud is a major problem? Are they just letting known fraudsters get away with it? Or, more likely, are they pulling these alleged fraud numbers out of thin-air?

In reality, the numbers thrown around by the insurance lobby about how much “fraud” is costing the system probably only make sense if we assume that every person whose neck hurts for more than a few weeks after an accident is committing “fraud” (which, in our experience, is not far off from how most insurers seem to view accident victims).

Fraud should not be tolerated. But there’s no evidence it’s as big a problem as the insurance lobby would have you believe. And their fixation on this red herring of an issue is more than just a harmless distraction. The repeated messaging that insurance fraud is a major issue – which the government has unfortunately bought into – is really about twisting public perception so that accident victims begin to be seen as greedy, lying fraudsters, rather than as struggling, injured people. When that’s the public perception, it’s a lot easier to drive through a reform agenda that reduces funding for accident victims.

When it comes to the “epidemic” of auto insurance fraud, to quote Flavor Flav, don’t believe the hype.

2. STANDARD TREATMENT PLANS

BUDGET PROMISE: “IMPLEMENTING STANDARD TREATMENT PLANS FOR COMMON INJURIES SUCH AS SPRAINS, STRAINS AND WHIPLASH”

We already have standard treatment plans for common injuries, and have for a long time.

The “Minor Injury Guideline” was introduced back in 2010. Thanks to the MIG, 80% of accident victims in Ontario have their funding for physiotherapy and other rehabilitation costs limited to a maximum of just $3,500 (by far the lowest amount of any province in Canada1), and people are expected to always be fully recovered after just one or two courses of treatment. And before the MIG, we had the Pre-Approved Framework, which served a similar function in terms of prescribing pre-set treatment plans.

So what exactly is changing here?

You can bet that the real changes will be to expand what qualifies as a “minor injury,” to limit treatment funding for more people, and to take healthcare decisions away from individuals & their healthcare providers by restricting them to a one-size-fits-all framework.

How can the government seriously try to spin this as a positive development?

3. LAWYERS’ FEES

BUDGET PROMISE: “ENSURING THAT LAWYERS’ CONTINGENCY FEES ARE FAIR, REASONABLE AND MORE TRANSPARENT”

Let’s settle this once and for all: Lawyers’ fees have exactly zero to do with insurance rates.

This argument is so incoherent that it’s difficult to imagine that even the people making it believe what they are saying.

When a lawyer charges a contingency fee, that fee comes out of the money the client recovers because of her/his injuries. A lawyer’s contingency fee does not increase the amount the client is entitled to recover, and any contribution made by a losing defendant to a plaintiff’s legal costs would be paid regardless of what the lawyer’s agreement is with her/his client.

Whether a lawyer charges 5%, 50%, or an hourly rate, it has zero effect on the amount the insurance company pays. And in fact, a change in 2016 means that people’s own insurance companies now pay zero contribution towards injured people’s legal costs, even if the insurer has been found to have wrongfully denied benefits, delayed an injured person’s treatment and forced a long and expensive legal battle.

Is it important that contingency fees are fair? Absolutely! Should contingency fee agreements be clear and follow all the rules? We sure think so! But do contingency fees have anything whatsoever to do with insurance rates? Say it with me, now: NO!

4. DESIGNATED ASSESSMENT CENTRES

BUDGET PROMISE: “REDUCING DISPUTES BY ESTABLISHING INDEPENDENT EXAMINATION CENTRES”

Centralized, supposedly “independent” assessment centres became a key feature of Ontario’s auto insurance system all the way back in 1994. They continued until they were finally scrapped in 2006 because the system turned out to be an unworkable disaster and these centres were blamed for raising insurers’ costs. But now, we’re going back to them to lower costs…?

These “Designated Assessment Centres,” or DACs, were expensive, over-burdened, slow, and were dominated by insurer-friendly assessors who regularly prevented injured people from getting the funding they needed until they could go through a long and expensive dispute resolution process. In all likelihood, the new system will end up facing the exact problems that the old one faced. Only this time, injured people may be completely stuck with the findings of these assessors, no matter how bad they may be.

The idea of independent assessors sounds great in theory, but we already know from past experience that it won’t reduce costs, and it won’t improve care for injured people.

The real solution is obvious: Imagine how much money would be saved if insurers just trusted treating doctors to make recommendations for their patients’ care, rather than turning every treatment plan into a battle of competing “experts,” or subjecting an injured person to a battery of assessments from a DAC team! Patients would receive better and appropriately-customized care, disputes would be rare, and resources wouldn’t be wasted on costly assessments, lawyers and tribunals.

SO WHAT DO WE DO?

The point of this rant isn’t to get you upset with the current governing political party in particular, nor to suggest that any other party would be better. It’s important to remember that all three major parties are to blame for today’s mess of an auto insurance system. Those “Designated Assessment Centres”? Introduced by the NDP. The “Minor Injury Guideline”? Introduced by the Liberals. And the PCs? They drastically slashed all the benefit amounts available to injured people – income, medical, and attendant care. They’re all to blame.2

The trouble is that most people only think about auto insurance when they pay their premiums – they don’t think about the benefits they are paying for until they’ve been hurt in an accident and actually need them. Without fail, when we tell new clients who have just had their lives turned upside-down by an accident just how limited their rights and benefits are, they are shocked and upset.

Governments of all stripes respond to what the public cares about, and if most people only care about rates, that’s all they will focus on. From there, governments from every party have bought into the insurance lobby’s talking points, believing that it’s impossible to see rate reductions without even further slashing of benefits (even though our rates are higher than they’ve ever been, despite cut after cut). All the while, insurers’ profit margins are protected.

If we want to see real progress, Ontarians need to make clear to their politicians that they care about more than just rates, and that they want to be sure the insurance protection they are paying so much for is actually there for them when they need it.

In the lead-up to the provincial election, let’s make sure that we’re talking about benefits and the rights of injured people, not just premiums and protecting insurance company profits.

Talk to your MPPs, inform your friends and colleagues, support and follow the Ontario Trial Lawyers’ Association and their #TruthAboutInsurance campaign, and don’t stop demanding change.

Ignorance has taken over. We gotta take the power back.

1 See this paper at Table A1.

2 To be fair, it’s tough to say where the fourth party, the Greens, stand on auto insurance, other than wanting to introduce pay-as-you-drive premiums – which is not a bad idea for an outside-the-box way to try to lower premiums without reducing benefits. But we don’t know where the Greens stand on protecting benefits coverage – it would be great to hear more from them on this.